Flux’s Prediction Market Could Be The Key To Decentralized Insurance Markets

Flux is a decentralized, open-source prediction market engine launched in 2020. Like its competitors Augur, Omen, and Gnosis, Flux provides a platform for users to purchase the right to collect payment if a future event occurs. In other words, it allows users to place bets on all kinds of future events and provides a market for anyone to buy and sell those bets as the event draws closer and the outcome becomes more certain.

Making predictions is an interesting use case, but hidden within is a much, much bigger one. The multi-trillion dollar insurance industry shares the same functional framework as a prediction market bet: 1) pool funds, 2) evaluate event outcomes, and 3) pay funds to those who hold valid payout claims. The Flux protocol contains all the decentralized infrastructure for every one of these insurance industry functions, and its potential is incredible.

But before we get to possibilities with insurance, let’s look at some prediction market use cases that are already working.

Prediction markets as financial instruments

A highly publicized use case has been election predictions, and indeed there’s evidence that prediction markets tend to give better prediction results than most voter polling methods. That’s a nice benefit, but we are interested in the asset itself. As an election draws closer it may become clear that one candidate is ahead, and the market price of that candidate’s claim will climb. This allows someone holding that bet to exit their position and realize a profit before the election occurs. In this way, a bet on a candidate becomes a financial instrument with a stable or volatile price.

Sports betting is another common case that’s available on Flux today. This is another multi-billion dollar industry in its own right, with highly sophisticated oddsmakers traditionally employed by casinos or online companies.

Advantages of decentralization

Prediction markets have been around for a while, but decentralized versions offer big advantages over traditional centralized services. Blockchains ensure untamperable records, permissionless access, and direct payments without possibility of censorship or third party control. Oracles provide verification of whether or not the event occurred in a number of tamper-resistant ways. Decentralized markets offer permissionless access to users worldwide. The permissionless nature of these markets also allows anyone to create new markets for events they are interested in. Many rent-seekers and middlemen are cut out of the process, reducing costs. Decentralization allows democratization of any financial assets imaginable.

Flux and NEAR blockchain technology

Flux is built on the NEAR blockchain, which offers some remarkable advantages over other ERC20-based prediction markets. Flux is highly scalable, with a system that can process transactions at a speed of over 80,000 per second. It’s cost-effective, with transaction fees of about $.01 USD. NEAR also allows easy integration with existing apps, and of course NEAR will soon have a bridge allowing trustless swaps with ERC 20 assets. Assets on Flux can operate as L1 NEAR assets or L2 ERC20 assets. None of Flux’s competitors can come close to these performance and interoperability features.

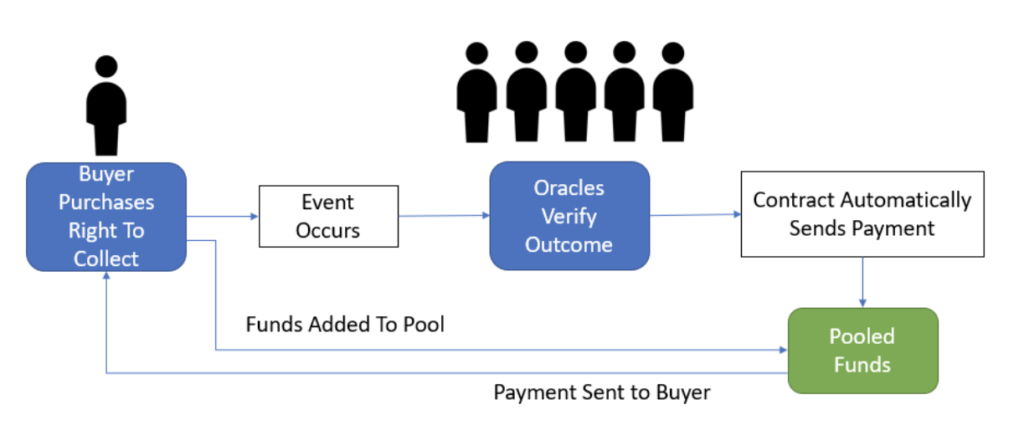

Steps of prediction market bets and claims

Let’s take a look at the basic steps involved in using a decentralized prediction market. First, the user buys a right to collect a payout. Then the event occurs and is verified by oracles. Then the contract automatically makes the payout to the user’s account.

The potential of decentralized insurance

Worldwide insurance premiums are a staggeringly huge market. They currently represent about $5 trillion USD per year, which is a little over 5% of worldwide GDP spent on insurance. The world’s largest insurance provider, Allianz SE, has over $1.1 trillion USD in assets, and many other companies are close behind.

Refer to the diagram above and you’ll notice that the process of buying and claiming a prediction market bet follows the same basic steps found in insurance. The user purchases insurance, makes a claim, has it approved, and receives payment. Incorporated in these steps is everything needed for:

- Property insurance

- Life insurance

- Health insurance

- Commercial insurance

- Liability insurance

Decentralized insurance has the potential to expand the worldwide insurance market even further by bringing policies to people who currently have less access to financial services, while cutting out expensive middlemen such as brokers, adjusting agents, and asset managers.

The new technology of oracles

What’s standing in the way? Mostly just time and getting more projects built, but probably the biggest opportunity for improvement is oracles. Decentralized insurance is already available for easily-verified events such as crypto contract hacks and flight delays. That’s because a big part of insurance is verifying whether the payout event (accident) has taken place, which is the job of oracles.

Decentralized oracles are an area of intense research. How do you verify whether a house was destroyed in a hurricane if you are across the globe or relying on algorithms?

The Flux protocol relies on some game theory to incentivize honest behavior. If someone makes a claim to an outcome, they are required to stake a specified amount of stablecoin. Any person or group can stake an equal amount of coins to dispute this outcome. If it’s a clear violation, anyone can step in and get paid to keep the claimant honest.

If the amount staked in dispute is at least as much as the claimant has staked, the protocol owner has to investigate and make a judgment on the outcome. The winner of the dispute gets to keep the other party’s coins. This is not necessarily a perfect or highly scalable solution, but it is one that works well in the vast majority of insurance use cases, and is easily adapted to nearly any area of insurance. The system promises to work well for the time being as oracle solutions continue to improve.

The Flux AMM platform as an insurance market

Let’s say you now have a claim. The right to claim an event-based payout, whether it has occurred or not, is a valuable asset. Flux comes with its own automated market maker platform as the infrastructure for buying and selling these kinds of rights. It’s a platform directly comparable to AMMs like Uniswap, Sushiswap, and Curve (some of the highest-valued projects in DeFi). The AMM platform opens up possibilities for using claims (possible future payments) as borrowing collateral or tradable assets in their own rights. Remember that the possibility of a payout may change over time as an event becomes more or less likely to occur. Someone holding a policy just before an obvious payout event (such as a flood or looming crop shortage) could liquidate their policy and access the value before the destructive event even begins.

The Flux AMM platform also offers unprecedented freedom for people to create new kinds of insurance products according to their particular needs. Any firms, governments, organizations, professionals, or individuals can open their own custom markets for any future outcome.

Flux represents next-generation financial services infrastructure

Flux is a scalable open-source protocol enabling markets for any asset, commodity, or event. Its asset prices are always self-updating with new information, and prices are difficult to manipulate.

Think of all the assets available on Uniswap and imagine a fully-realized marketplace of tradable insurance-based assets. You’ll be able to buy insurance, set up new markets, and trade on your special knowledge of likely future events. It’s still got a long way to go, but all the basic pieces are here and the system works.

If this sparks your imagination, try it out yourself. Setting up a market on Flux is easier than you may think and the best way is to learn by doing. Reach out to Flux on their Twitter, or join their Telegram group.

Share this:

Join the community:

Follow NEAR:

More posts from our blog